“This isn’t, ‘I need to be able to get a contract to order more computers and more storage.’ It’s ‘I need it now,’” Edwards says.

Artificial intelligence and machine learning tools assist with crunching the numbers and helping to allocate resources. FEMA has pilot programs in procurement and finance using robotic process automation to churn through the data and make sense of it, Edwards says.

IT programmers set the rule to query the database, and bots do the work. The bots boost operational efficiency, reducing human interaction for routine tasks.

Disaster survivors’ data “has to be protected, kept secure so bad guys cannot access that information,” Edwards says. “This isn’t just about the technology, it’s about the people and processes as well.”

MORE FROM FEDTECH: How edge computing brings cloud closer to the data for agencies.

SBA’s Serverless Architecture Helped Speed Up the Loan Process

Providing emergency loans isn’t new for SBA; it can initiate its existing assistance program once a locality or region has been declared a federal disaster area. For COVID-19, this declaration happened for the entire U.S. at once, when President Donald Trump declared a national emergency in March 2020 in response to the spread of the coronavirus. The SBA was able to put its disaster assistance program into action as a result.

The CARES Act, passed just two weeks after the emergency declaration in April 2020, triggered two SBA loan programs: the Economic Injury Disaster Loan (EIDL), which existed prior to the pandemic but was altered to get the money to recipients faster; and the new Paycheck Protection Program for loan disbursement.

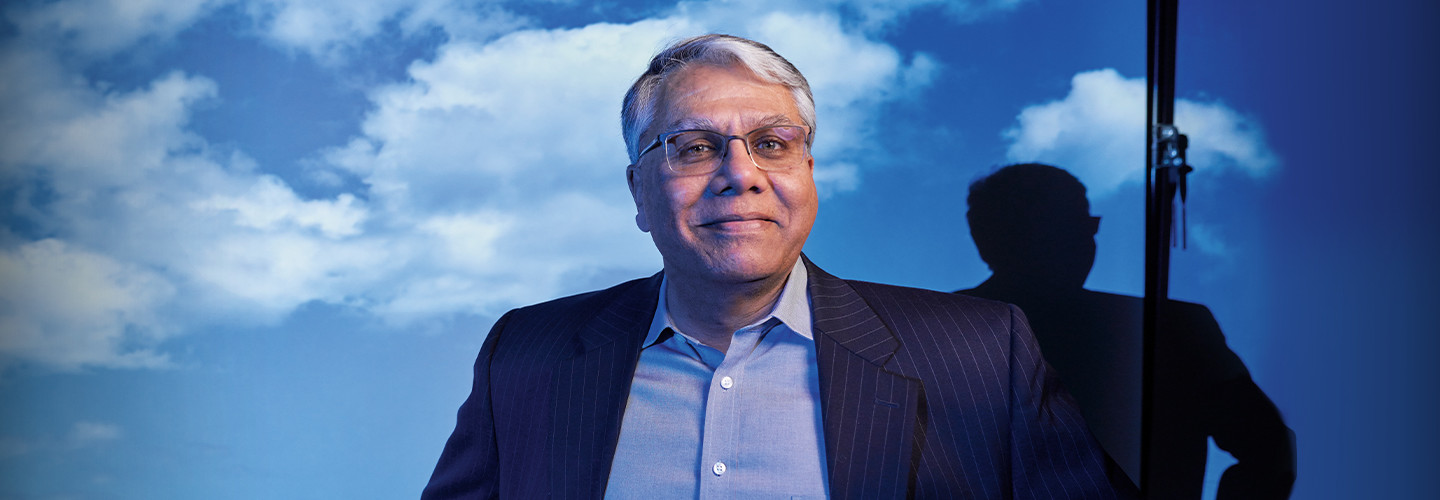

SBA.gov saw huge traffic spikes after those programs were created. On April 3, 2020, a Trump tweet about SBA sent user numbers soaring, multiplying them by a factor of 150 “in the blink of an eye,” Gupta says.

The site had been previously moved to cloud infrastructure and built with a serverless, immutable architecture, so it was able to scale in real time and manage the surge smoothly, he says.

Within 24 hours, the agency had put up an online portal for application submissions, Gupta says, and set up a “Find a Lender” guide so borrowers could seek loan processing options.

EXPLORE: Learn which data belongs in the cloud.

“The measure of time changed for us,” he says. “We were no longer talking in weeks or months or quarters. It was hours.”

In the first 14 days of the PPP, SBA delivered the same number of loans it had delivered over the past 14 years, OPSM’s Kucharski said during an ATARC webinar in April.

“The No. 1 priority was that we were in the middle of an emergency, we had small businesses that were failing at a record rate, and we had to get funds out at a quick pace,” he says.

If there has been a silver lining to the pandemic, Gupta says, it’s that it created a sudden shift to a digitally savvy workforce. Employees have grown used to processing digital documents and accepting e-signatures, while also increasing their use of online collaboration and office productivity tools.

“It has, if you will, brought on the digital transformation that we’ve all been trying to get to for a long time now,” he says. “I cannot imagine how much paper we have not used in the past 12 months.”